TastyTrade - Best Practices

Monday, November 25, 2013

Sunday, November 24, 2013

TOS Tip: Adjusting Cost Basis in TOS Risk Profile

11/24/13

When analyzing a position with Thinkorswim's Risk Profile it isn't accurate if you modified the original trade by rolling, closing half an iron condor, etc. For example, below is the risk profile for a current position in JCP.- BTO +10 Jan14 11 C

- STO -10 Dec13 8 P

It shows I am currently up $170, with a max profit of $190 at Jan expiration if JCP stays between 8 and 11. This is confirmed by checking the closing order, which would be a debit of $20. However, TOS is ignoring my original trade and that I rolled the short puts.

Friday, November 22, 2013

TT - MM: Scaling into Strength, 11/22/13

TastyTrade - Market Measures

Take-away:

If we enter a trade based on high IV Rank, and the IV Rank continues to rise, does this warrant scaling the position by selling more premium?

- Entry: past 5 years in FXE, IWM, and TLT

- IV Rank > 50%

- Sell 1SD strangle w/45DTE

- If IV Rank increases by 10 (say, from 55% to 65%) sell another 1SD strangle

- Results: In these non-stock (indexes) examples it paid off 28 out of 29 times to scale in.

JCP Leap

9/30/13 -Open

With JCP down -35% in the past 2 weeks, and dipping below $9 for the first time in 13 years it's time to buy into weakness.

The IV is 101% with a recent range of 48-116%. That places the current IV in the 78%-tile (101-48)/(116-48). So we'll collect some of the inflated premiums in the puts and use the credit to help finance a LEAP.

- JCP @8.81

- BTO +10 Jan 11 C

- STO -10 Nov 8 P

- Debit = 0.16 * 10 = $160

Labels:

-OPEN,

JCP,

Risk profile

Monday, November 18, 2013

TT - MM: Duration and Volatility, 11/18/13

TastyTrade - Market Measures

Take away:

- Entry: IWM, XLE, EEM, GLD, and EWZ

- Sell 1SD strangle when IV Rank crosses above 80%

- Compare 18 DTE and 45 DTE

- Exit: Manage trades at 25%, 50%, and 75% of max profit

- Compare to staying in until expiration

Saturday, November 16, 2013

IV Rank Strategies

High IV Rank - over 50%

- Sell premium and bank on vol contraction

- Short OTM credit spreads

- If bullish, short put spreads

- If bearish, short call spreads

- If neutral, short strangles and iron condors

Low IV Rank - under 50%

- Buy premium and bank on vol expansion

- OTM debit spreads have negative time decay!

- Buy ATM debit spreads for less than intrinsic value to see positive theta

Friday, November 15, 2013

TT - MM: High Probability Strangles, 11/15/13

TastyTrade - Market Measures

Takeout:

When making high probability trades in large indices with high IV Rank, how do we manage winners based on P/L per day?

- Entry: 5 years in SPX, NDX, and RUT

- IV Rank above 50%

- Sold a 2SD Strangle (97.5% OTM)

- Exit:

- 25%, 50%, and 75% of max profit

- Compared to closing day prior to expiration to avoid assignment

- NDX had highest P/L-per-day at 25%

- RUT had highest P/L-per-day at 50%, but only slightly more than at 25%

- SPX had highest P/L-per-day at 25%

- Short strangles tie up lots of capital so managing winners at 25% returns the highest P/L-per-day and reduces the number of days in trade

- If you don't need to free up the capital, let these high probability trades run!

Thursday, November 14, 2013

TT - MM: Chicken Iron Condors, 11/14/13

TastyTrade - Market Measures

Note: Increasing the credit taken in reduces the risk (possible loss) but also decreases the probability of success.

When used in the appropriate situations this strategy outperformed the 'standard' strategies in P/L, drawdown, and expected winners. Collecting 50% of the strikes should have resulted in a 50% success rate and yet was actually profitable 60% of the time. (1SD iron condors have an expected success rate of 68.2% while the 33% trades should win 67% of the time)

Take-out:

This strategy only works at earnings and for high priced stocks. For lower priced equities the short strikes get too tight and it's hard to collect enough premium.- Entry: 2 years in AAPL, NFLX, AMZN, GOOG, and MA

- High IV Rank (above 50%)

- Sell iron condor 1 day before earnings

- Compare:

- Collect 45-50% of the width of the strikes (risk = 50-55%)

- Collect 33% of the width (risk = 67%)

- Sell shorts at 1SD (risk = 84%)

- Exit:

- Close (BTC) 1 day after earnings

Note: Increasing the credit taken in reduces the risk (possible loss) but also decreases the probability of success.

When used in the appropriate situations this strategy outperformed the 'standard' strategies in P/L, drawdown, and expected winners. Collecting 50% of the strikes should have resulted in a 50% success rate and yet was actually profitable 60% of the time. (1SD iron condors have an expected success rate of 68.2% while the 33% trades should win 67% of the time)

Wednesday, November 13, 2013

NTAP Earnings Play

11/13/31 -Closed

- Iron Condor, NTAP @41.23

- STO -1 Nov 43/44C 39/38P

- Credit = .37

- Risk = 63

- ROR = 58% in 2 days

11/15/13 Update:

- NTAP @41.15

- BTC +5 Nov 39P

- Debit = .01

- Net = $36, 56% in 2 days

CRM Earnings Play

11/13/13

CRM reports earnings on 11/18. Here are some possible trade setups. Unfortunately, there aren't any Nov4 strikes between 61 and 65. I will wait until closer to earnings before entering any of the trades. The strikes may have to move and the IV should go up.

First, an IC with $1 wide strikes. Since 61 is the highest $1 strike it has a high chance of being tested on the top.

- Iron Condor, CRM @ 57.13

- STO Nov4 60/61C 53/52P

- Credit = 0.50

- Risk = 50

- ROR = 100% in 9 days

- BE = 52.50 & 60.50

WMT Earnings Play

11/13/13

WMT reports earnings tomorrow before market open. Current IV Rank is low at 41% which is keeping premiums low. Looking back at movement-after-earnings for the past 2 years the stock dropped 6 times while only gaining twice. Here's a possible bearish IC with the expected move shown below.

- Credit = 0.35

- Risk = 65

- ROR = 54% in 2 days

Tuesday, November 12, 2013

ADBE High IV Rank

11/12/13 -Closed

ADBE has an IV Rank of 95% so we are looking for a vol contraction. We'll be entering a Dec IC with 38DTE. By tightening the call side slightly we can increase our credit, reduce our risk, and give the IC a slightly bearish bias.

- Iron Condor, ADBE @56.02

- STO Dec 57.5 C

- BTO Dec 60 C

- STO Dec 52.5 P

- STO Dec 50 P

- Credit = 1.20

- Risk = 130

- ROR = 92%

- BE = 51.30, 58.70

KSS Earnings Play

11/12/13 -Closed

KSS reports earnings on 11/14 before market open. The IV Rank is over 90% and the expected move of +/-2.83 by expiration is represented on the risk profile below. As you can see the break-even price levels are outside the expected move. NOV option vol should contract from 59% down to 28%.

- Iron Condor, KSS @57.33

- STO Nov 60 C (75% OTM)

- BTO Nov 62.5 C

- STO Nov 55 P (75% OTM)

- BTO Nov 52.5 P

- Credit = 0.72

- Risk = 178

- ROR = 40%

- BE = 54.28, 60.72

Update: 11/14/13

KSS opened -$4.65, ouch. Roll the puts and let the calls expire.

- Roll, KSS @54.18

- STO Dec 55/52.5P Nov 55/52.5P

- Credit = .17

Update: 12/18/13

- BTC Dec 55/52.5P @0.59

- Net = $30

- ROR = 17% in 36 days

Monday, November 11, 2013

RAX Earnings Play

11/11/13 -Closed

Here's an Iron Condor based on an earnings play in RAX.

The screen capture is from the morning after (cha-ching!) so ignore the P/L and volatility figures. The price slices represent the MMM of +/-5.29, while a volatility contraction of 75 points is expected (130% to 55%).

- Iron Condor, RAX @49.14

- STO -1 Nov 55 C (80% OTM)

- BTO +1 Nov 57.5 C

- STO -1 Nov 42.5 P (84% OTM)

- BTO +1 Nov 40 P

- Credit = 0.70

- Risk = 180

- ROR = 39% in 4 days

11/15/13 Update

Closed at 50% max profit.

- BTC Nov 42.5/40P @ .35

- Net = $35, 19% in 4 days

TT - MM: High IV Rank Occurrence, 11/11/13

- High IV Rank Strategies:

- short strangle

- short iron condor

- short iron butterfly

- short vertical

- naked put

- Low IV Rank Strategies:

- put debit spread (ITM/OTM)

- calendar

- double diagonal

How often does High IV Rank occur?

Wednesday, November 6, 2013

TT - MM: IV Rank and Managing Winners, 11/06/13

Carry-out:

- Entry: look at AAPL and GOOG back to 2008, PCLN back to 2010

- High IV Rank (> 50%)

- Sold Big Boy Iron Condor w/45DTE

- Short strikes at 84% OTM

- Wings are 20 points out ($20 spreads)

- Exit:

- 25%, 50%, and 75% of max profit

- Compare to holding until expiration

- If target wasn't reached the position was held until expiration

- Determine drop in IV Rank over length of trade

- Close at 25% to maximize P/L-per-day and free up capital

- Close at 50% to maximize P/L and reduce losers

- No reason to hold longer (unless perhaps IC is centered and POT of shorts is very low)

Tuesday, November 5, 2013

PCLN Earnings Play

11/5/13

This is an earnings play on PCLN. We got in a little early because the premium was so good. IV for the NOV2 weeklys is 78% and should drop to around 34% after earnings on 11/7. The expected move of 65 points by expiration is shown on the risk profile.

TT - MM: Iron Condors - How Much Premium, 11/05/13

TastyTrade - Market Measures

Carry-out:

- Entry: look back 5 years in AMZN, GOOG, and SBUX

- High IV Rank (> 50%)

- Sell Iron Condor w/45DTE:

- Collect 33% and 45% width of the spreads

- Compare to 1SD IC

- Exit: hold until expiration

- The risk on an iron condor is inversely related to the reward (credit taken in).

- During high IV rank the 1SD strikes are too conservative and carry too much risk in extreme cases.

- Sweetspot for high IV Rank Iron Condor:

- IV Rank above 50%

- 45DTE

- 45% Credit

Monday, November 4, 2013

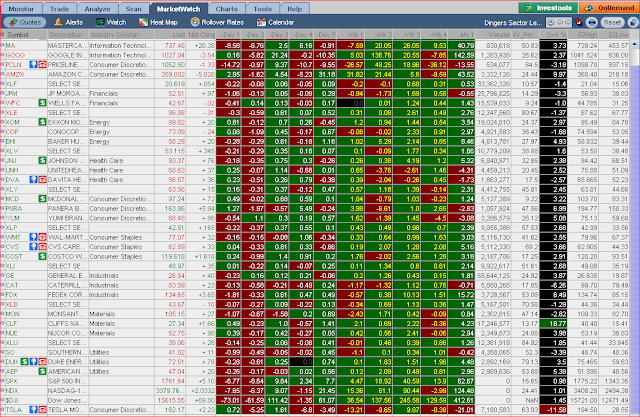

thinkScript: Custom Quote - Strength or Weakness Indicator

Updated 11/04/13

Use this custom quote to highlight stocks showing strength or weakness. '2wk %' will turn green when a stock has a 10% gain in 2 weeks, and turn red for a 10% loss.Here's how it looks if you use the default black background:

and here's how it looks with the metal background:

Instructions for using this code can be found here: TOS Tip: Custom Quotes

####begin custom quote: 2wk %

#

# Displays the greater up or down price change over the last 2 weeks. 10% or greater = Green. -10% or less = Red.

#

# by John Latrobe

# revised 11/04/13

#

# length is # of trading days. 10 = 2 weeks.

def length = 10;

def price = FundamentalType.CLOSE;

def pricePercentUP = 10.0;

def pricePercentDOWN = -10.0;

#

def priceday = Fundamental(price, period = aggregationPeriod.DAY);

def high = Highest(priceday[1], length);

def low = Lowest(priceday[1], length);

def PcntChHigh = 100 * (priceday/high -1);

def PcntChLow = 100 * (priceday/low -1);

#

plot PercentChg = if(AbsValue(PcntChHigh) >= AbsValue(PcntChLow), Round(PcntChHigh, 2), Round(PcntChlow, 2));

AssignBackgroundColor(if PercentChg >= pricePercentUP then Color.DARK_GREEN else if PercentChg <= pricePercentDOWN then Color.DARK_RED else Color.CURRENT);

PercentChg.AssignValueColor(color.WHITE);

#

#####end quote.

thinkScript: Custom Quote - Daily/Weekly/Monthly Gain or Loss

Updated 11/04/13

Instructions for using this code can be found here: TOS Tip: Custom Quotes

#

# Shows gain or loss 1 trading day ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[1] - priceday[2];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

#

# Shows gain or loss 2 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[2] - priceday[3];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

#

# Shows gain or loss 3 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[3] - priceday[4];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

#

# Shows gain or loss 4 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[4] - priceday[5];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

#

# Shows gain or loss 5 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[5] - priceday[6];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

#

# Shows gain or loss last 5 trading days for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[1] - priceday[6];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

#

# Shows gain or loss for week ending 6 trading days ago (days -10 thru -6) for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[6] - priceday[11];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

#

# Shows gain or loss for week ending 11 trading days ago (days -15 thru -11) for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[11] - priceday[16];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

#

# Shows gain or loss for week ending 16 trading days ago (days -20 thru -16) for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[16] - priceday[21];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

Instructions for using this code can be found here: TOS Tip: Custom Quotes

Daily Price change 1 trading day ago:

#####begin custom quote: -Day 1#

# Shows gain or loss 1 trading day ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[1] - priceday[2];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

Daily Price change 2 trading days ago:

#####begin custom quote: -Day 2#

# Shows gain or loss 2 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[2] - priceday[3];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

Daily Price change 3 trading days ago:

#####begin custom quote: -Day 3#

# Shows gain or loss 3 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[3] - priceday[4];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

Daily Price change 4 trading days ago:

#####begin custom quote: -Day 4#

# Shows gain or loss 4 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[4] - priceday[5];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

Daily Price change 5 trading days (1 week) ago:

#####begin custom quote: -Day 5#

# Shows gain or loss 5 trading days ago for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[5] - priceday[6];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

Weekly Price change for past week (last 5 trading days):

#####begin custom quote: -Wk 1#

# Shows gain or loss last 5 trading days for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[1] - priceday[6];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

Weekly Price change 2 weeks ago (trading days -10 thru -6):

#####begin custom quote: -Wk 2#

# Shows gain or loss for week ending 6 trading days ago (days -10 thru -6) for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[6] - priceday[11];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

Weekly Price change 3 weeks ago (trading days -15 thru -11):

#####begin custom quote: -Wk 3#

# Shows gain or loss for week ending 11 trading days ago (days -15 thru -11) for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[11] - priceday[16];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

Weekly Price change 4 weeks ago (trading days -20 thru -16):

#####begin custom quote: -Wk 4#

# Shows gain or loss for week ending 16 trading days ago (days -20 thru -16) for an equity or index.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[16] - priceday[21];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.YELLOW);

#

#####end custom quote.

Monthly Price change for past month (last 21 trading days):

#####begin custom quote: -Mo 1

#

# Shows gain or loss for past month (trading days -21 thru -1) for an equity or index.

# -Mo 2 would use trading days -42 thru -22, etc.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[1] - priceday[22];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

#

# Shows gain or loss for past month (trading days -21 thru -1) for an equity or index.

# -Mo 2 would use trading days -42 thru -22, etc.

# GREEN = Gain, RED = Loss.

# Use to customize a column in MarketWatch Quotes or Stock Hacker Scans.

# Paste this code into 1 of the 19 custom fields.

#

# by John Latrobe

# revised 11/04/13

#

DEF price = FundamentalType.CLOSE;

DEF priceday = Fundamental(price, Period = AggregationPeriod.DAY);

#

PLOT pricechg = priceday[1] - priceday[22];

AssignBackgroundColor(if pricechg > 0 then Color.DARK_GREEN else if pricechg < 0 then Color.DARK_RED else Color.CURRENT);

pricechg.AssignValueColor(Color.WHITE);

#

#####end custom quote.

Subscribe to:

Posts (Atom)